The homes market and mortgage rates are changing. Amber Housholder shows us the programs and perspective to put your best financing and offer together when buying a home. She lays out some unique programs and explains some basic aspects of mortgages home buyers need to know.

Dave Jackley

Hi, Dave Jackley here with another edition of Exactly At Home North of Pittsburgh. And today I have the pleasure of speaking with Amber Housholder, of Guaranteed Rate Affinity, a correspondent mortgage lender, which we’re going to find out about in a second. And all the things you need to know about borrowing money to buy your house. Okay, Amber, first thing, what is the difference of a correspondent lender from other kinds of lenders that people could go to?

Amber Housholder

A correspondent lender is bigger than a broker. So we do everything ourselves, we do our underwriting ourselves, our closing, our funding. So everything is done under the Guarantee Rate, Affinity’s umbrella, and then once a customer closes, the possibility then of them being sold to an outside investor typically happens a couple of months after closing versus if you’re going with a broker who’s smaller, they’re lining you up with the that third party lender right away, that’s where your mortgage is being sold in your servicing. So that’s sort of the difference and enables us to work with the larger banks across the country.

Dave Jackley

So I mean, the funds come from lots of sources, but is this where Fannie Mae and those kinds of people come in?

Amber Housholder

Yes, Fannie, Freddie Ginnie, those are our biggest investors. So we align ourselves with their underwriting guidelines. And most large entities follow along behind them. So if you’re underwriting for Fannie or Freddie, you’re lining up with just about everyone else in the marketplace.

Dave Jackley

Interesting now, is that they used to be government back, but But are they independent agencies now, or how does that work?

Amber Housholder

They’re independent agencies, they had some support during the pandemic, to keep everything moving along. But now slowly, that supports being taken away, which is sort of what’s, you know, happening in the economy right now, and also kind of bringing mortgage rates to be a little bit higher than they had been?

Dave Jackley

Interesting. So I think the people watching are gonna be very interested in your programs, your products or processes. But I got to ask you one question, before we get into that, you know, people are in a panic out there about rates going up, what what would you say to a person that’s facing that, and now’s their time to buy a house?

Amber Housholder

You’re dating the rate, you’re not marrying it. You’re getting an interest rate now. And it could be something that in the future, there’s something better. So you can move along to a different rate with refinancing. If the rates don’t come down in the timeframe that you’re interested in, then basically, you’ve got the best thing going. So you know, you’re not stuck in it forever. Yes, there’s a cost to refinancing. But you can balance that with how much you’re gonna save in the interest rate. So it would become a discussion to have to make sure it’s a good move for you. But if now’s your time to buy a house, historically, rates are low. They’re just not low compared to where we’ve come from.

Dave Jackley

Interesting.

So if I paid on my mortgage for a while, and I’ve knocked the principal down, or, you know, if my late uncle leaves me a chunk of change, and I can apply that to the house, can I both refinance and recast the loan out to lower my monthly payments at that point in time?

Amber Housholder

Yes, but those are two separate things. So when you’re refinancing, you’re getting a whole new mortgage loan, so you’re going through the process all over again, you’re incurring the same expenses. You don’t incur transfer stamps on a refinance because you already own it, but title insurance, getting another appraisal going through employment verifications, things like that, versus recasting and most most investors do have recasting. But it’s not a not 100%. There’s usually a small fee, like a few $100. But the nice thing about recasting is they’ll take a lump sum of money, usually $10,000 or more, and they will apply it towards your principal, and they will reduce your monthly payment. So you’re not changing your interest rate. You’re not incurring all the closing costs, but you are making your monthly payment lower. And that’s the difference between the recast or they also call it re amortization versus a refi. And, you know, again, recasting, you can’t have any mortgage lates you have to have made like six, six months of payments. Before you know they’ll let you go ahead and do that. And usually they don’t have a limit, you can do it more than once. So there you go. That’s why you need Amber. You have questions like that you got it.

Dave Jackley

Okay, well tell me how did you get into this business? How long have you been into it? What do you like about it?

Amber Housholder

It’s funny, I think it’s funny. I took real estate as an elective course in college and just loved it. And so I have a degree in real estate and finance. So I started out working more along the lines of relocation. And, you know, at that time, many moons ago, it was developing websites and having some online presence. And then the opportunity became available for working in the company’s mortgage company. So I think it’s more than 20 years ago, I started doing that. And it’s that’s the course so you got the experience. What? What do you like most about what you do? I just like when getting people to close. I enjoy meeting and talking with people and getting them pre approved. But whenever I’m making the calls or contacts, like, everything’s good, this is your final number, you’re going to closing just the excitement. And you know, it’s a it’s a trek, it’s a journey. I feel like I’m the guide. And when you make it to the end, it’s fun, it’s happy. It’s a great thing when you can help people get through the front door, so to speak.

Dave Jackley

Well, I know you’ve got some unique programs with your company to get people, like we say through the door through closing, do you want to talk about any of those?

Amber Housholder

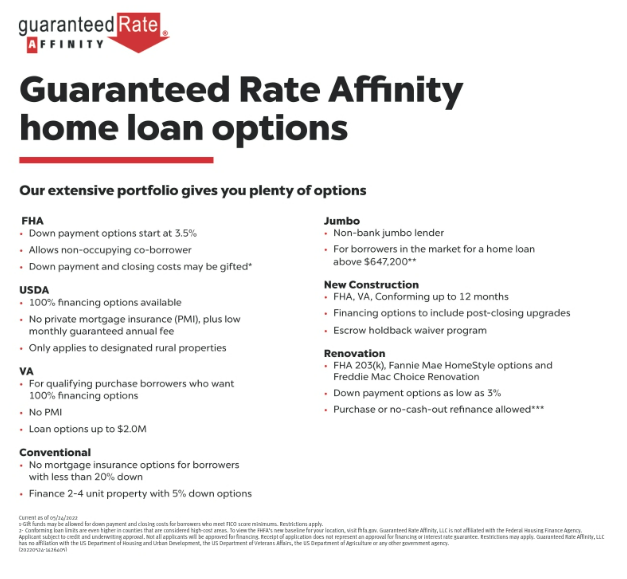

Sure. I think with our investors, we have virtually all the programs you would need to buy a property that’s a single family up to a four unit. I just I don’t have a lot loan, I don’t do commercial loans. But if there’s any type of FHA, VA, first time homebuyers, jumbo loans, regular 5% down loans, Fannie products, Freddie products that help with down payments and closing cost assistance. So it’s sort of soup to nuts. There’s also renovation loans. So if you find a house that’s a little rough, and with some TLC, it could be like your dream home, we have those products as well. So to enhance some of those things, you know, there’s ways to work on getting that information during the pre approval process for each customer.

Dave Jackley

Terrific. Yes, well, here we are in the middle of 2022. The severe seller’s market might be fading a little bit, but it’s still very competitive to buy a house. And I know you’ve got a power bid product. So how does that help a buyer that’s gone through your process be more competitive?

Amber Housholder

When they bid on a house, so this marketplace has made offers, like several offers coming in for the same house at the same time. And if someone has cash, it’s viewed as you know, that’s the way to go. So if someone does need financing, the question is how far along can we take them in the process so that they’re as good as cash. So power bid is designed to collect all the customers documents, like pay stubs, bank statements, W-2’s, have them signed disclosures, and actually have their file reviewed by an underwriter so that we know they’re approved to they have a commitment letter, and all they need to do is find the house. So specifically, the things the house, once they find it we would need to do would be an appraisal, and then the title work. And then as long as all that is okay, then we know we have everything put together. So it takes them, you know, a couple of steps closer in the mortgage process than someone who is just pre approved. That you know, so you’re you’re putting yourself ahead of the people who are pre approved and right up against the people who are cash buyers.

Dave Jackley

Interesting.

Wow. I can see where that would be a great advantage for buyers. And the other thing people if they worry about rates going up higher about locking in a rate, how can they lock in rates?

Amber Housholder

The couple of options usually, traditionally, when you find the house, you lock your interest rate because the the house purchase is based on you know, a certain date in the future to close. So you have to make sure that your interest rate covers you to your closing date will during this you know year 2022 We have what’s called a “Lock ‘N’ Roll”. So this is a program where you can lock an interest rate for up to 90 days while you’re shopping for a house, so if you think rates right now are low, you could enter into the lock and roll program. And then you know, shop for your house the next 30 to 45 days, and then you have 30 to 45 days to close, and you have that interest rate of today. And the great thing about it is there’s a one time float down. So if rates keep going up, then you’re golden, because you have the lowest rate. But if rates actually do dip down after you found your house, you can do a one time float down into a lower interest rate. So you’ve kind of got the best of both worlds.

Dave Jackley

Yeah, that’s terrific, not losing out.

Well, is there anything else right now that people people need to know?

Amber Housholder

I’ve had a lot of questions about, you know, working with people that don’t have like a full down payment. So there are some programs that are much like FHA, but they’re conventional. So Fannie and Freddie each have their own actually, Freddie has to. So there are 3% down conventional programs, and you can ask for sellers assist to help offset some of your closing costs. And just in this marketplace, being in you know, Southern Butler County, there are USDA loans which are zero money down, you have to qualify income wise and location wise, but it does help because you can also ask for sellers assist. So it makes the cash to close as low as possible. So full down is usually what 10 or 20%.

So down payments, less than 20% can be as low as three. So 3% down to 20%. Down, you have mortgage insurance. And once you go over 20% down, then you don’t have mortgage insurance anymore. And on conventional loans, once you hit 20% down the mortgage insurance drops from the mortgage payment so your payment would actually get a little bit lower.

Dave Jackley

Terrific. Well, I want to thank you for spending the time with me. There’s a lot of information here. And Amber has more information that I can tell you from working with her that she answers the phone all the time, and even on Saturdays when you’re trying to buy that house. And if you don’t have money in the bank, there’s lower down payment programs. So tune in again next time for another edition of Exactly At Home North of Pittsburgh..

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link